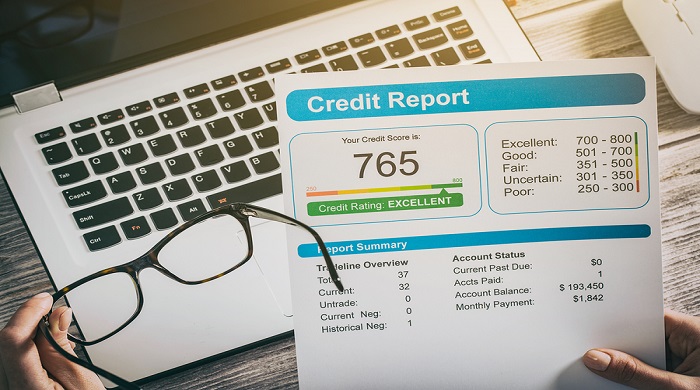

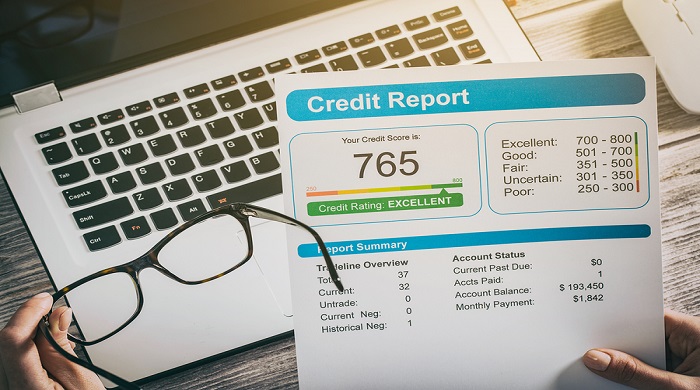

Your credit file is so important, and you might not even know it. Whenever you apply for credit of any kind, whether it is for a credit card, to purchase a new mobile phone on contract, or even for a mortgage application with a view to purchasing a new home, your credit score will be looked at by the potential lender.

If you have been rejected for any form of credit in the past it will have been a conclusion based on your credit score, which showcases how you live financially and how responsible you are in paying back your debts on a regular basis. Being an adult and managing multiple finances is hard work at times, and there are often many complexities that we face that are difficult to overcome. Every single financial transaction and commitment that we make will have an impact on our future selves, so it is important to understand your credit score and why it is so important to your life and future.

It is important to build a positive credit score. It takes time to achieve it, especially if you have no credit history, or adverse credit, but it is achievable with clear aims and a commitment and dedication to your approach.

Increase Credit without Overstretching – There are easy ways in which you can improve your credit score, but it is always with the caveat that you must be 100% sure that you are able to pay back your credit on time and regularly. Take out credit cards, store cards with pleasing interest rates and use these on a regular basis. You could, for instance, use a credit card to pay for your grocery shopping each month. This should only be done however, if you are putting aside the cash to pay for those groceries at the time, and then using that cash to pay off the credit card when your next statement is delivered.

Take Out a Payday Loan – In much the same way that a store or credit card can be used to build good credit in a responsible way, a payday loan can be taken out if you have the means to pay it back within the agreed timeframe. If you need some extra cash for just the next week, choose a responsible payday loan lender and have the money ready to pay back within the agreed limits. Never take out a short-term loan if you cannot afford to pay it back within the timeframe agreed.

Check Your Credit File – You should also regularly check your credit file for inaccuracies. Equifax, Experian, and TransUnion are the credit agencies in the UK. You can check your credit file for free, and you should do so regularly to ensure that all the information that they hold is accurate and up-to-date. False information can have a detrimental impact on your ability to acquire credit in the future.

Always be proactive with your personal debt and your credit file. Adverse credit can have a long-term negative impact on your life, so be sure to move away from personal debt and build a good credit score in a systematic way.